Understanding the Path: What is CA?

The Role of a Chartered Accountant

Chartered Accountants (CAs) are recognized as key professionals in the financial and accounting sectors. They are qualified to provide a variety of services, including auditing, tax advice, financial planning, and consulting for both businesses and individuals. Unlike traditional accountants, CAs hold a prestigious certification that signifies a higher level of expertise and adherence to professional standards.

Importance of CA in India

In India, the role of a Chartered Accountant is indispensable. With the growth of the Indian economy and the increasing complexities in financial regulations, businesses, both large and small, require qualified professionals to navigate these waters. CAs ensure compliance with tax laws, assist in strategic financial planning, and play a crucial role in corporate governance, thereby fostering a transparent business environment.

Career Opportunities after Becoming a CA

Becoming a CA opens a multitude of career opportunities across various sectors. Graduates can work in public practice firms, corporate finance, internal auditing, and consulting. Furthermore, many CAs choose to establish their own practice, allowing them to provide tailored services to their clients. In the corporate world, CAs are often positioned in senior management roles due to their financial acumen, leading to career advancement opportunities.

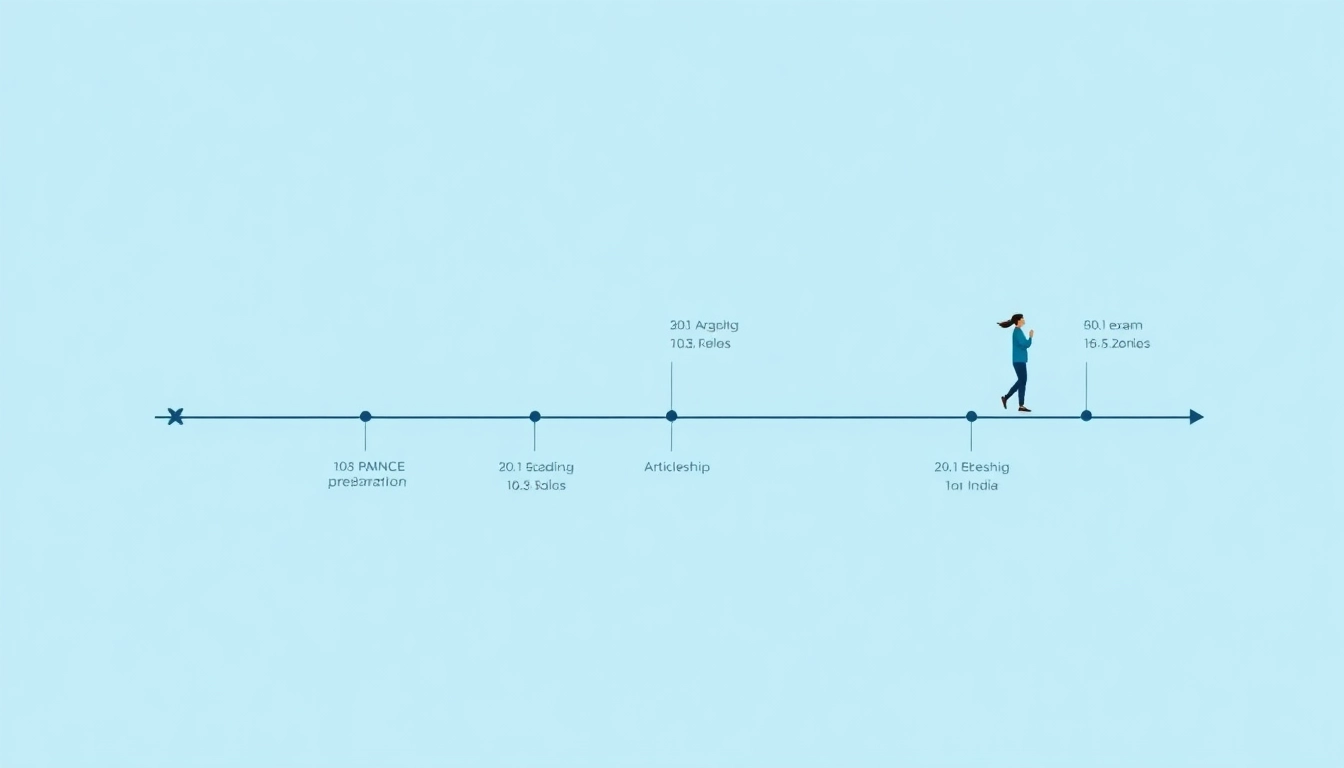

Duration Overview of CA Course

CA Course Timeline Breakdown

The CA course is typically structured into three levels: Foundation, Intermediate, and Final, along with practical training known as Articleship. The entire process usually spans approximately 4.5 years to 5 years.

- Foundation Course: This first stage requires about 4 months of study.

- Intermediate Course: Students generally take about 8 months for each group.

- Final Course: The final stage requires a similar timeframe as the Intermediate levels.

- Articleship: This practical training lasts for 3 years.

In total, the course duration sums up to about 48 months of formal study and training.

Duration after Different Educational Backgrounds

The route to becoming a CA may vary depending on one’s educational background:

- After 12th Grade: The duration is approximately 5 years, including the completion of the Foundation, Intermediate, and Final exams, along with the Articleship.

- After Graduation: Graduates can complete their CA in about 4.5 years through the Direct Entry Scheme.

This flexibility supports aspirants from diverse academic backgrounds, making the profession accessible to a wider audience.

Essential Training and Articleship

One of the defining aspects of the CA curriculum is Articleship, which provides hands-on experience in the field. The Articleship period involves working under a qualified CA, enabling students to apply theoretical knowledge to real-world scenarios. This practical experience not only reinforces learning but is also a crucial factor in preparing aspirants for the challenges they will face in their careers.

CA Duration After Graduation

Explaining the Direct Entry Scheme

The Direct Entry Scheme allows graduates from specific streams to initiate their journey towards becoming a CA without completing the Foundation course. Eligible candidates must possess a minimum percentage in their undergraduate degree, typically in commerce or related fields. This scheme reduces the overall course duration to approximately 4.5 years, as graduates can commence with the Intermediate level exams right away.

Phases of the CA Journey Post-Graduation

Post-graduation, the path to becoming a CA includes the following phases:

- Registration for CA Intermediate.

- Preparation and Examination for Intermediate levels.

- Commencing Articleship during or after Intermediate exams.

- Final examinations after completing Articleship.

The structured phases ensure that candidates receive comprehensive training before graduation as Chartered Accountants.

Comparing Duration for Graduates and Undergraduates

Typically, graduates can complete their CA journey in approximately 4.5 years compared to the 5 years required for undergraduates, primarily due to exemptions from the Foundation level. This comparison highlights the advantages for graduates in terms of time saved and immediate engagement in advanced accounting principles and practices.

Factors Influencing CA Duration in India

Exam Pass Rates and Preparation Time

The duration for which an aspiring CA completes their qualification can significantly depend on individual performance in exams. The pass rates for each level can fluctuate significantly based on various factors, including the student’s preparation strategy and the number of attempts taken. It is common for students to require multiple attempts to pass the exams, which naturally extends the overall duration of the CA program.

Impact of Articleship on Overall Duration

As mentioned earlier, Articleship is a pivotal component of the CA curriculum. The length of the Articleship can influence the total time spent in the program. Students often begin their practical training during the Intermediate exams, which allows for concurrent studies. However, the rigors of Articleship can also impact the students’ ability to focus on their exams, thereby potentially prolonging their journey to becoming qualified CAs.

Individual Study Pace and Strategies

Each candidate has a unique study pace influenced by prior knowledge, study habits, and resources available. Those who develop clear study strategies and maintain consistent study schedules may progress more quickly through the curriculum. Conversely, those who lack organization or face external challenges may take longer to qualify. Adopting effective study techniques like breaking down topics, using practice exams, and joining peer study groups can significantly enhance learning speed and retention, ultimately impacting the duration taken to qualify.

General Tips for Aspiring CAs

Study Plans for Efficient Exam Preparation

The CA examination is known for its difficulty. Developing a well-structured study plan is crucial for success. Candidates must allocate their time wisely, balancing their studies between theoretical concepts and practical applications. Incorporating mock tests and past question papers into their preparation also affords students the opportunity to gauge their understanding and make necessary adjustments early in their study plan.

Finding the Right Coaching and Support

Choosing the right coaching institution can have a significant impact on success rates. Aspiring CAs should seek out coaching centers with a proven track record, experienced instructors, and effective study material. Additionally, utilizing online resources and forums can provide additional support and insights beyond conventional classroom learning.

Maintaining Motivation Throughout the Journey

As the journey toward becoming a CA can be lengthy and challenging, it is essential for candidates to maintain their motivation throughout the duration of their studies. Setting short-term goals and celebrating small wins can help sustain enthusiasm. Engaging with fellow aspirants and attending CA seminars can also foster a supportive environment that encourages perseverance.

Understanding ca duration in india is critical for aspiring chartered accountants, as it enables them to plan their educational journey effectively. By grasping the course structure, the associated timelines, and the factors that can influence their duration, students can set realistic expectations and chart their course more successfully.